Back in January SmartGrandad posted an article “Will 2025 be the Tipping Point for Uk EV car sales?“. In this article we see how things have progressed at a European + Uk level, during H1 2025 and whether or not the “Tipping Point” has been reached.

The European new car market (EU+EFTA+UK) contracted by 0.9% in H1 2025, with the EU market specifically seeing a 1.9% decrease.

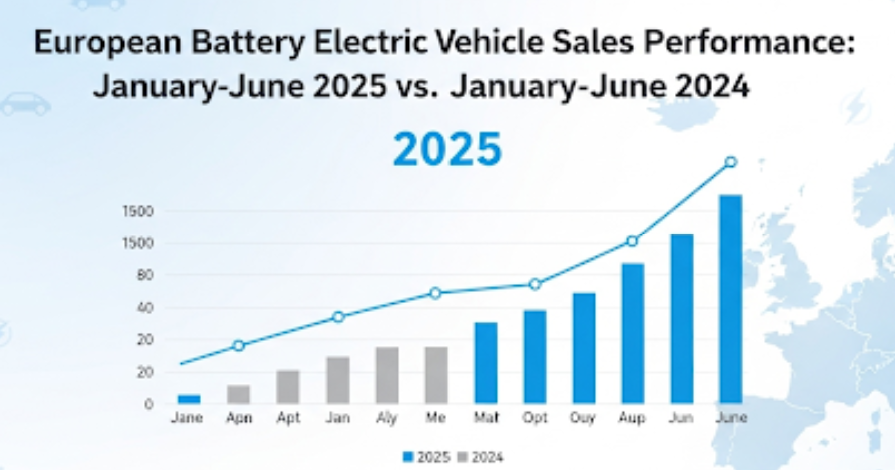

Overall BEV registrations across Europe, encompassing the European Union (EU), European Free Trade Association (EFTA), and the United Kingdom (UK), surged by nearly 25% in H1 2025, reaching 1,190,346 units, a notable increase from 953,309 units recorded in H1 2024.

This expansion propelled the BEV market share from 14% to 17% across this broader European scope.1 Within the EU specifically, BEV sales climbed by 22% to 869,271 units, securing a 15.6% market share, an increase from 12.5% in H1 2024.

Zone | Jan-Jun 2025 (BEV) Units | Jan-Jun 2024 (BEV) Units | % Growth |

EUROPEAN UNION | 869,271 | 712,451 | 22.0 |

EFTA | 96,234 | 73,762 | 30.5 |

United Kingdom | 224,841 | 167,096 | 34.6 |

EU + EFTA + UK | 1,190,346 | 953,309 | 24.9 |

Of course sales in each country are different. See the chart below for those countries leading the switch to EVs and those slipping behind.

Factors such as evolving consumer preferences, strategic shifts by manufacturers (e.g., Volkswagen Group’s strong performance contrasting with Tesla’s challenges), and varied national incentive structures are influencing these regional disparities.

Affordability and the development of charging infrastructure remain persistent challenges that continue to shape market evolution.

Country | H1 2024 Sales | H1 2025 Sales | BEV Sales Growth % |

| Iceland | 957 | 2,283 | 138,6 |

| Spain | 25,146 | 46,235 | 83,9 |

| Czechia | 4,146 | 6,91 | 66,7 |

| Slovenia | 1,649 | 2,7 | 63,7 |

| Slovakia | 1,233 | 2,008 | 62,9 |

| Poland | 8,861 | 14,256 | 60,9 |

| Cyprus | 496 | 735 | 48,2 |

| Denmark | 38,917 | 57,178 | 46,9 |

| Austria | 22,178 | 31,534 | 42,2 |

| Lithuania | 851 | 1,205 | 41,6 |

| Norway | 51,418 | 70,748 | 37,6 |

| Germany | 184,125 | 248,726 | 35,1 |

| United Kingdom | 167,096 | 224,841 | 34,6 |

| Bulgaria | 863 | 1,135 | 31,5 |

| Portugal | 19,214 | 25,017 | 30,2 |

| Italy | 34,939 | 44,726 | 28,0 |

| Greece | 3,341 | 4,265 | 27,7 |

| Ireland | 10,737 | 13,629 | 26,9 |

| Latvia | 586 | 743 | 26,8 |

| Finland | 10,569 | 12,726 | 20,4 |

| Belgium | 64,404 | 76,98 | 19,5 |

| Sweden | 42,003 | 49,667 | 18,2 |

| Hungary | 4,653 | 5,219 | 12,2 |

| Switzerland | 21,387 | 23,203 | 8,5 |

| Netherlands | 60,28 | 63,94 | 6,1 |

| Luxembourg | 6,435 | 6,559 | 1,9 |

| France | 158,402 | 148,332 | -6,4 |

| Estonia | 649 | 444 | -31,6 |

| Malta | 1,239 | 805 | -35,0 |

| Romania | 5,743 | 3,201 | -44,3 |

| Croatia | 792 | 396 | -50,0 |

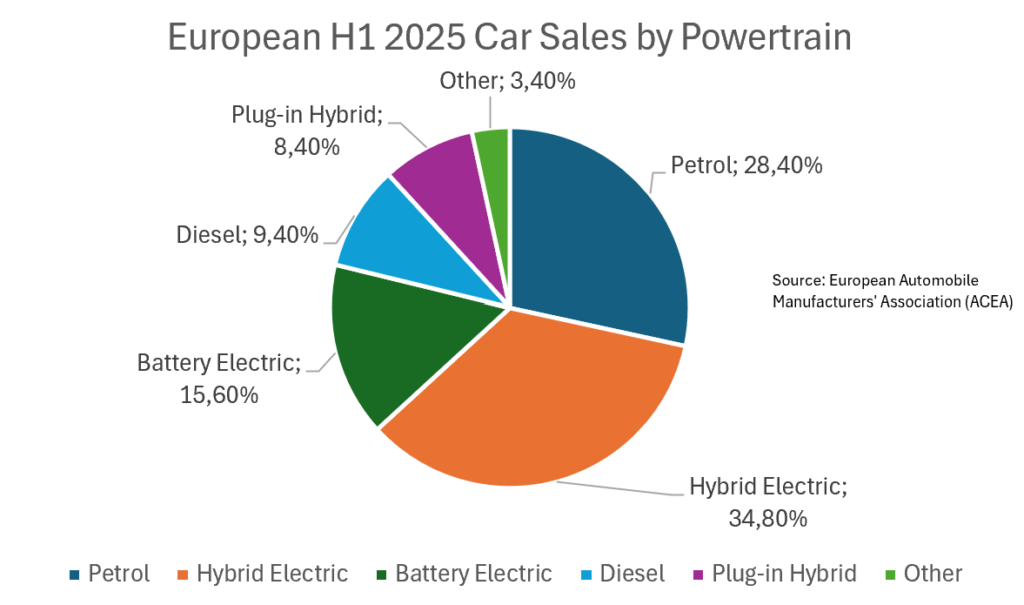

The combined market share of petrol and diesel cars in the EU fell sharply to 37.8% in H1 2025 from 48.2% in H1 2024.2 Specifically, petrol registrations declined by 21.2% and diesel by 28.1%.

This decline in ICE market share directly corresponds with the increase in BEV market share, which rose to 15.6% in H1 2025 from 12.5% in H1 2024 for the EU. This signifies that the growth in BEV market share is primarily a result of the ongoing energy transition, where BEVs are directly displacing ICE vehicles, rather than simply expanding the total car market.

This accelerating structural shift within the automotive industry means that competitive dynamics are intensifying in the powertrain segment, and traditional automakers face increasing pressure to electrify their fleets or risk losing market share.

It also underlines the effectiveness of regulatory pressures and consumer shifts in driving the market away from fossil fuel-powered vehicles, even before the full impact of policies like the 2035 ICE ban.

For manufacturers, the landscape is changing rapidly. Particularly Tesla’s vulnerability amidst the rise of new entrants and the resurgence of traditional automakers, indicates that the European BEV market is rapidly maturing and becoming intensely competitive. Tesla’s early-mover advantage is demonstrably eroding as both legacy automakers and new, aggressive entrants bring compelling and often more affordable models to market.

This suggests that brand loyalty alone is no longer sufficient; product innovation, competitive pricing, and effective localized strategies (including navigating policy changes and addressing consumer sentiment) are now paramount. The decline of a major player like Tesla, while others surge, indicates a dynamic re-ordering of market leadership, which will likely lead to increased price competition and a wider array of choices for consumers.

This also signals a shift from a “first-mover” advantage to a “best-product-and-strategy” advantage.

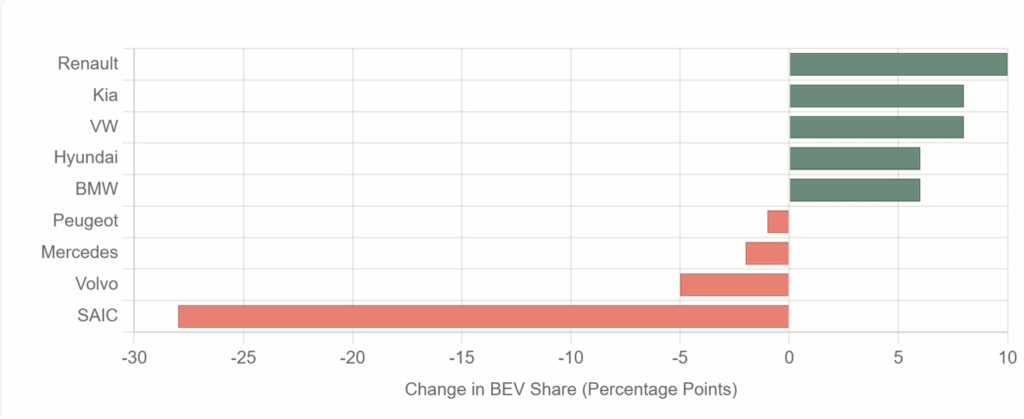

This chart highlights the change in BEV market share for key automotive groups in H1 2025 compared to the previous year, revealing the winners and losers in the race to electrification.

Data sourced from ACEA reports for H1 2025.

The European BEV market is characterized by an evolving and increasingly competitive landscape. Here are some of the consequential changes.

Volkswagen Group consolidated its leadership as the foremost manufacturer of BEVs in Europe in H1 2025, with several of its models ranking among the best-selling electric cars. The Volkswagen brand specifically increased sales by an impressive 157% during Q1 2025 to become the leading electric car brand. Their BEV share increased by 8 percentage points in H1 2025.

In contrast, Tesla experienced significant declines in Europe during H1 2025. While the Model Y remained the top BEV model, its sales were flat in June 2025 despite overall BEV growth. Tesla recorded a substantial 30% drop in registrations in March 2025, following even steeper declines in January (-47%) and February (-44%), resulting in a 38% decline for Q1 2025.14 This decline is attributed to a “host of PR issues” and the “changeover of the Model Y”, as well as rising competition from new players like BYD and traditional automakers like VW. Tesla is now “relying on the Model 3 to offset the losses”.

BYD emerged as a standout performer, registering 70,500 cars in H1 2025, a staggering 311% increase. In June, it sold 15,565 cars, placing it among Europe’s top 25 brands and outselling established players like Suzuki, Mini, and Jeep. The BYD Seal U was also noted as a top-selling PHEV in June.

The BMW Group saw its all-electric vehicles make an important contribution, accounting for an 18.3% share of total sales in H1 2025, with electrified vehicles (BEV+PHEV) amounting to 26.4%. BMW’s BEV share increased by 6 percentage points in H1 2025.

Other manufacturers, demonstrated strong growth in their electric car segments;

Kia (+8 percentage points BEV share),

Hyundai (+6 percentage points BEV share),

Renault (+89% electric car sales), and

Skoda (+93% electric car sales)

Conversely, Mercedes and Peugeot lost electric car market share, while Volvo BEV sales were down by nearly a third. Notably, SAIC (brands MG, MG IM, ROEWE, MAXUS & RISING AUTO), experienced a sharp drop from a 41% BEV share in H1 2024 to 13% in H1 2025.

The European Battery Electric Vehicle market is currently in a phase of robust growth, significantly outpacing the overall declining new car market in the first half of 2025.

Consumers are demonstrating, strongly, their dislike of ICE powered cars with only 37,40% of new car sales in H1 2025, a steep decline which is likely to continue going forward.

Whilst BEVs are being purchased by 15,60% (almost 1 in 5), most customers are taking the “safe” option and buying Electric Hybrids 43,20%.

The “Tipping Point” for BEVs may still be some years away, as consumers wait for better batteries, more range and lower prices. With battery technology certain to improve, the need for Fossil fueled Hybrids is bound to reduce as trust in BEVs grows stronger.

Despite the persistent challenges, the overall situation for BEV sales is anticipated to improve over 2025. This improvement is largely expected due to a projected fall in the average price of BEVs, driven by the introduction of more affordable models from mainstream automakers. This indicates that the next significant wave of BEV market growth will be heavily dependent on the availability and uptake of more affordable electric models.

S&P Global Mobility projects global BEV sales to reach 15.1 million units in 2025, representing a 29.9% increase over 2024 levels, and accounting for approximately 16.7% of the global light vehicle market. Europe is expected to be a major contributor to these global sales figures.

In Europe, while BEV sales are expected to be strong, overall vehicle production is projected to decline. This implies that the industry is undergoing a fundamental transformation, where long-term viability and market leadership will be determined by an OEM’s agility in adapting to the electric transition and their ability to offer competitive, compliant products that meet evolving consumer and regulatory demands.

The European BEV market, while demonstrating robust growth, continues to navigate a landscape marked by persistent challenges. The outlook for 2025 and beyond will be shaped by how these challenges are addressed and how manufacturers and policymakers adapt to evolving market conditions.

Affordability remains a significant barrier for consumers, with high average retail prices of new BEV models and concerns about low residual values. The “new vehicle affordability issues” are explicitly noted as not expected to be resolved quickly in 2025. This suggests that the market is transitioning beyond early adopters who could absorb premium pricing.

Charging Infrastructure concerns persist regarding its adequacy, accessibility, and reliability across the continent, serving as a key impediment to widespread adoption. While some countries are making progress in expanding their charging networks, a comprehensive and seamless network is still required to alleviate consumer anxieties.

General Consumer Uncertainty around electrification continues to influence purchasing decisions.7 This can stem from a variety of factors including perceived technology readiness, range anxiety, and convenience of charging.

Policy and Regulatory Shifts also play a crucial role. The tapering of EV subsidies and the imposition of EV tariffs (e.g., on Chinese imports) are influencing market growth and competitive dynamics. Political uncertainty in key markets like Germany and France also impacts consumer and manufacturer confidence.

The Intensifying Competition from new, aggressive players like BYD and the strategic pivot of traditional automakers (e.g., VW Group’s strong BEV performance) are creating an intensely competitive landscape, potentially leading to price wars and margin pressures.